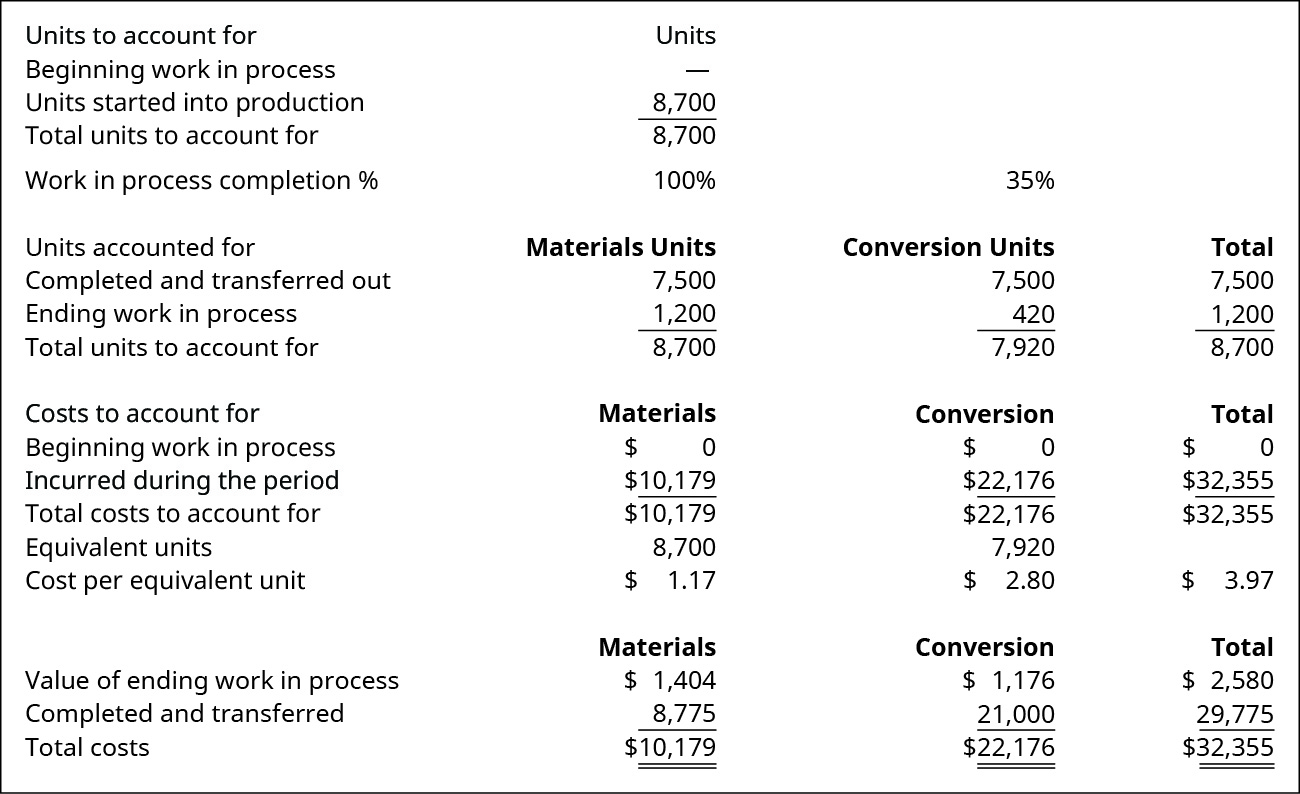

The \(1,200\) ending work in process units are only \(35\%\) complete with regard to conversion costs and represent \(420 (1,200 × 35\%)\) equivalent units. We must first FINISH beginning work in process, add units started and completed and units remaining in ending work in process. Beginning learn how long to keep tax records work in process is fully complete for materials (or 100% complete) and 60% complete for conversion so to complete these units we will need NO (or 0%) materials and 40% of conversion (100% – 60%). Units started and completed are always 100% complete for materials, labor and overhead!

How much will you need each month during retirement?

- Based on this percentage of completion, number of equivalents units is calculated in order to find cost per completed unit.

- Mathematically, this is done by converting the partially completed units into fully completed units and then adjusting the output figure.

- Now, check your understanding of the FIFO method of computing ending and work-in-process inventory using process costing.

- This is called the Weighted Average method and there are other methods too (discussed below).

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- Equivalent units (EU) is a way to measure partially completed products as if they were fully completed.

The beginning step in computing Department B’s equivalent units for Jax Company is determining the stage of completion of the 2,000 unfinished units (remember units completed and transferred are always 100% complete). In Department B, the ending units may be in different stages of completion regarding the materials, labor, and overhead costs. Assume that Department B adds all materials at the beginning of the production process.

Equivalent Units – FIFO Method

Accountants often assume that unitsare at the same stage of completion for both labor and overhead.Accountants call the combined labor and overhead costs conversioncosts. Conversioncosts are those costs incurred to convert rawmaterials into the final product (meaning, direct labor andoverhead). The limitation of equivalent units computation is that it does not take into account the number of units completed in any specific unit. For example, let’s assume that a company manufactured 2000 motorcycles for this year and 30% of motorcycles were lost due to defects.

Do you already work with a financial advisor?

Often there is a different percentage of completion for materials than there is for labor. Accountants often assume that units are at the same stage of completion for both labor and overhead. Accountants call the combined labor and overhead costs conversion costs.

Evaluation of Equivalent Units of Production

Trying to determine the value of those partial stages of completion requires application of the equivalent unit computation. The equivalent unit computation determines the number of units if each is manufactured in its entirety before manufacturing the next unit. For example, forty units that are 25% complete would be ten (40 × 25%) units that are totally complete. The equivalent production for each department is determined, which is later used to calculate the cost per unit of each job order by apportioning their total costs on basis of equivalent units.

Equivalent units (EU) is a way to measure partially completed products as if they were fully completed. The reason we do it is because it helps to calculate the costs of products that are not yet finished at month-end or year-end. Without this, we can’t assign costs to products in different stages of completion, so we won’t know the true costs at period end. Process costing is used to figure out how much it costs to produce items that are very similar or identical, like chocolate bars or cans of soda. In this costing system, costs are tracked for each step, or “process,” in the production, and then the total cost is divided by the number of units produced. It’s useful for companies making large quantities of similar products because it helps them understand cost per item.

We do this because it is easier to account for whole unitsthen parts of a unit. For example, if we have 3 units 1/3 ofthe way complete, we can add them together to make 1 equivalentunit (1/3 + 1/3 + 1/3). We can make this calculation easier bymultiplying the units by a percentage of complete. In this method, both the beginning and ending inventory is converted into equivalent units, so there is a bit more work to do.

Equivalent units under FIFO method of process costing are the number of finished units that could have been prepared in a process during a period had there been no unfinished units, either in opening WIP or closing WIP. For example, if we bring 1,000 unitsto a 40 % state of completion, this is equivalent to 400 units(1,000 x 40%) that are 100% complete. Accountants base this concepton the supposition that a company must incur approximately the sameamount of costs to bring 1,000 units to a 40% level of completionas it would to complete 400 units. Below you’ll find an example of a mini-lesson that helped my student, Wanda, understand how to calculate the started and completed units.

For example, building a custom piece of furniture or a unique construction project would use job costing. In this case, we would track the costs of materials, labor, and overhead for each specific job separately. Both methods help businesses understand and manage their production costs, but they are used in different situations based on the type of products being made. Essentially, the concept of equivalent units involves expressing a given number of partially completed units as a smaller number of fully completed units.