Since Robert F. Kennedy Jr.’s withdrawal, only Harris and Trump meet these criteria, so we are effectively forecasting the two-way popular vote between Democrats and Republicans. Polls from more frequently polled, but less well-regarded, firms had shown a more Trump-leaning race but also moved in Harris’s direction Monday. The 538 team and The New York Times’s Ruth Igielnik discuss whether a vice presidential debate can impact how viewers see presidential candidates Donald Trump and Kamala Harris. Our fourth deep dive into polling and other data in the seven key swing states. Our fifth deep dive into polling and other data in the seven key swing states.

Don’t Overestimate Sales Performance

Collecting and consolidating data from various teams is a labor-intensive and time-consuming process in the bottom-up approach. Historical company performance, industry growth rates, and economic indicators heavily influence top-down forecasting. The top-down approach to forecasting has earned a fan base among large organizations and those juggling multiple divisions as it grants a holistic perspective of the entire what is bottom up forecasting business. Top-down and bottom-up forecasting are two commonly-used techniques for building sales forecasts. It’s also true, that most modern sales organizations use hybrid models that factor in a multitude of variables to achieve the highest possible accuracy. Now you know the difference between top down and bottom up forecasting and how to overcome forecasting hurdles, you can make informed decisions and grow.

sales leadership

- The strengths and weaknesses of the business are then examined in relation to the potential of the wider market.

- This estimate allows businesses to project the outcomes of their results and accounts for any gaps in budgeting or personnel adjustments.

- Once all the meetings have been set up, and the KPIs have been explained, it’s time to collect the data.

- For instance, a company might develop a scenario where a new competitor enters the market, leading to price wars and reduced margins.

- The key difference between the top-down and bottom-up approaches is the perspective taken to perform your analysis.

- This is rather than taking a ‘top down’ view of the overall market (and assuming a share of market) and then translating it into company revenues.

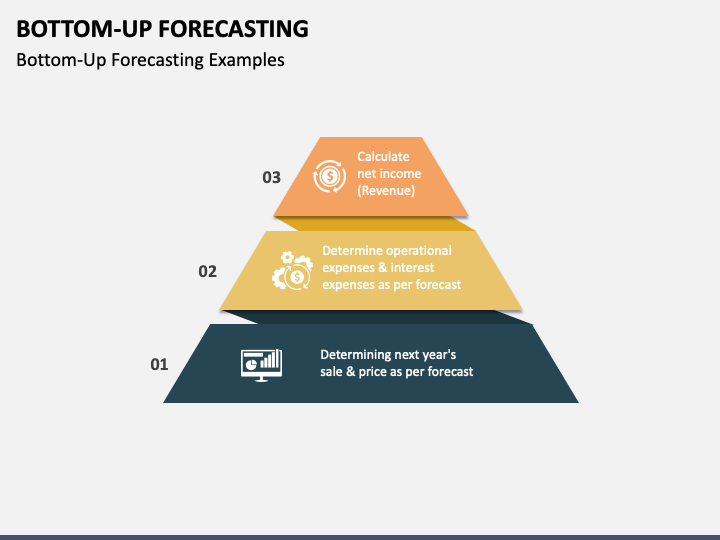

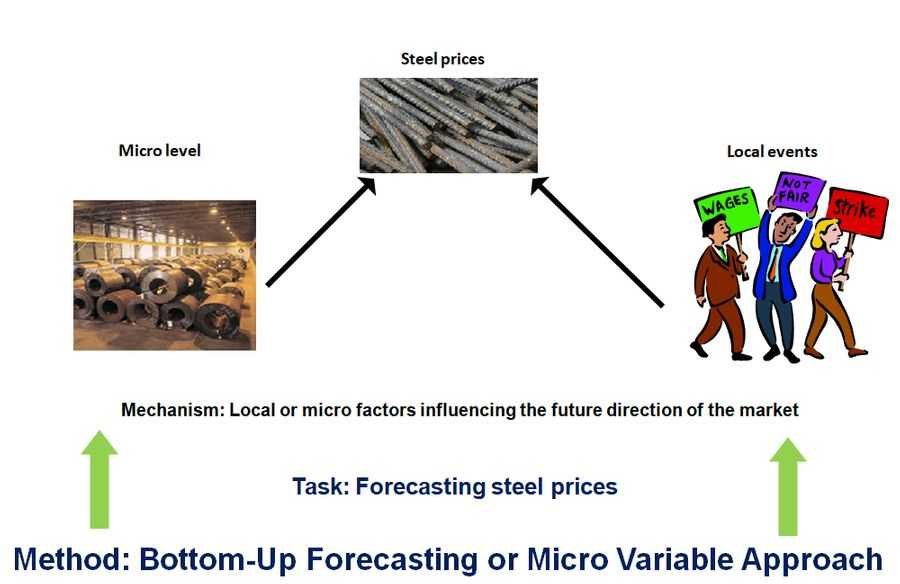

Bottom-up forecasting, on the other hand, starts with a granular approach to sales forecasting and looks inward to the product, service, activities, budget, and capacity the company currently maintains. Bottom-up forecasting is a method that starts with detailed, individual forecasts from lower levels of an organization and aggregates them to produce a higher-level forecast. This approach emphasizes input from frontline employees, enabling more accurate predictions based on real-time data and insights from those directly involved in operations. By using specific data points and localized knowledge, bottom-up forecasting can lead to more precise and responsive overall forecasts.

Why Do Businesses Invest in Sales Forecasting?

Financial forecasting is a crucial tool for any business because it enables you to anticipate profits. The ability to accurately predict fluctuations in revenue allows you to overcome cash flow issues and budget accordingly. While there are many methodologies for preparing a financial forecast, two of the most common are top-down and bottom-up analyses.

This financial modelling can be helpful in monitoring these data points and monitoring the sales performance. Bottom-up forecasting looks into each and every aspect of the everyday operations of the company. To create a successful revenue forecasting model, you need to know what factors impact your business, what drives sales, and how these factors are likely to change over time.

Level up your forecasting accuracy with Xactly

This method is particularly useful for identifying seasonal trends or cyclical patterns that can inform future forecasts. They must look at all their sales channels to analyze the number of expected orders coming from each. With products or services at different price points, they’ll need to determine the average cost, considering things like discounts or promotions.

With top-down forecasting, companies don’t need up-to-the-minute point of sale (POS) data to forecast results. Businesses that assess available market revenue from the top down—especially new ones—may find it easier to generate projections. As an added benefit, a top-down view evaluates whether a market is increasing or decreasing, so startups can easily gain insight into long-term profit potential. Understanding these differences will help you choose the right forecasting method for your business. Top down forecasting provides a strategic view, bottom up forecasting provides detailed and precise numbers. This guide provides a detailed comparison of top-down and bottom-up forecasting, helping you determine which approach best fits your business needs.

You’ll get a lot of valuable insights to develop effective marketing campaigns. Bottoms-up forecasting is a forecasting method that starts with the lowest level of detail (e.g., individual salespeople) and works toward the top (e.g., total sales). With this method, you first break down the total sales target into the smallest individual units and then do a forecast for each unit.

Collaboration across departments is another cornerstone of effective bottom-up forecasting. Since this method relies on input from various units within the organization, fostering a culture of open communication and data sharing is essential. For instance, sales teams can provide insights into customer behavior, while production units can offer data on manufacturing capabilities. This collaborative approach ensures that the forecast is grounded in the realities of each department, leading to more accurate and actionable predictions. This method begins with overall market conditions, industry trends, and high-level company goals to project future sales performance.